One-Stop Platform to Discover Expertise & Mastery in Accounting Practical Work & Profession.

Join the 4 Days LIVE Master Class on New Labour Codes and understand the complete impact of the new laws on wages, PF, ESI, and compliance. Learn practically and stay compliant with confidence.

Tried free videos but still confused about journal entries, GST, or real accounting? It’s not your fault — it’s how you’re learning.

Join the Tally LIVE Master Class – a practical, hands-on program designed to make you job-ready!

Life Time Access to Videos | Support From Your Mentor.

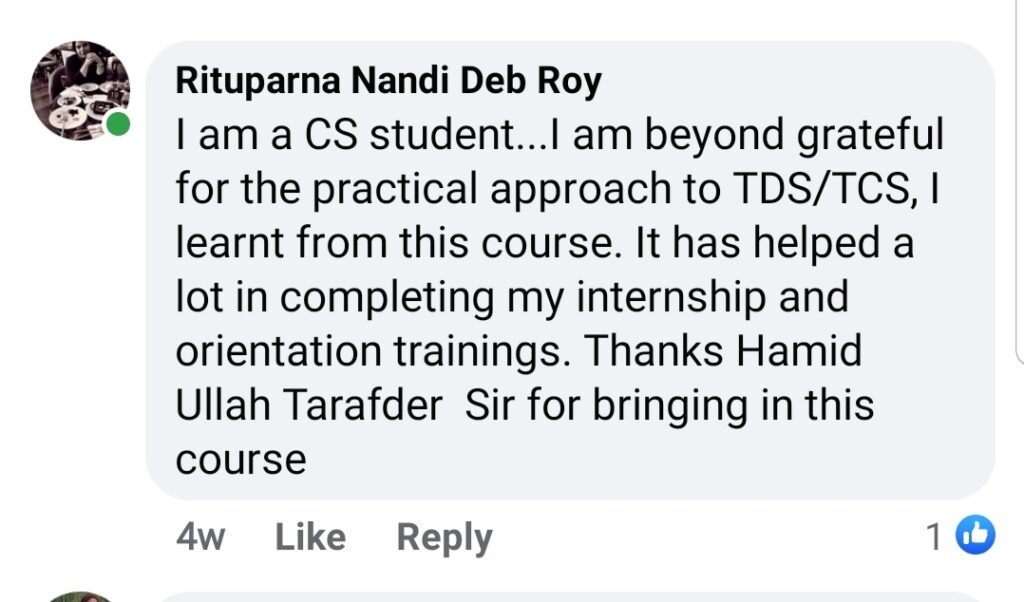

Why 60% of accountants stall on TDS/TCS

Bridging theory vs. practical TDS/TCS

TDS on salaries, commissions & services

TDS on cash withdrawals & TCS on sales (Sec 194P/194Q)

TDS on purchases above ₹50 Lakh

Form 26AS reconciliation & Annual Information Statement

Generating reports & certificates (Form 16/16A, NRI returns)

Correcting challans, late fees & OLTS filings efficiently

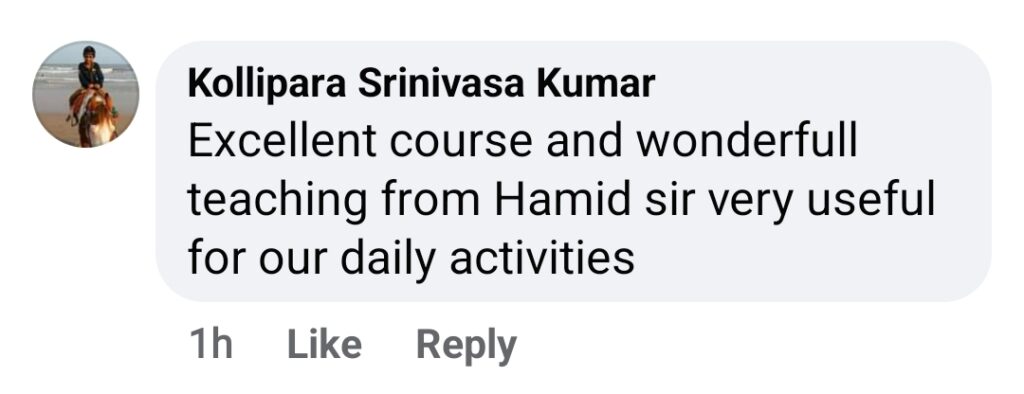

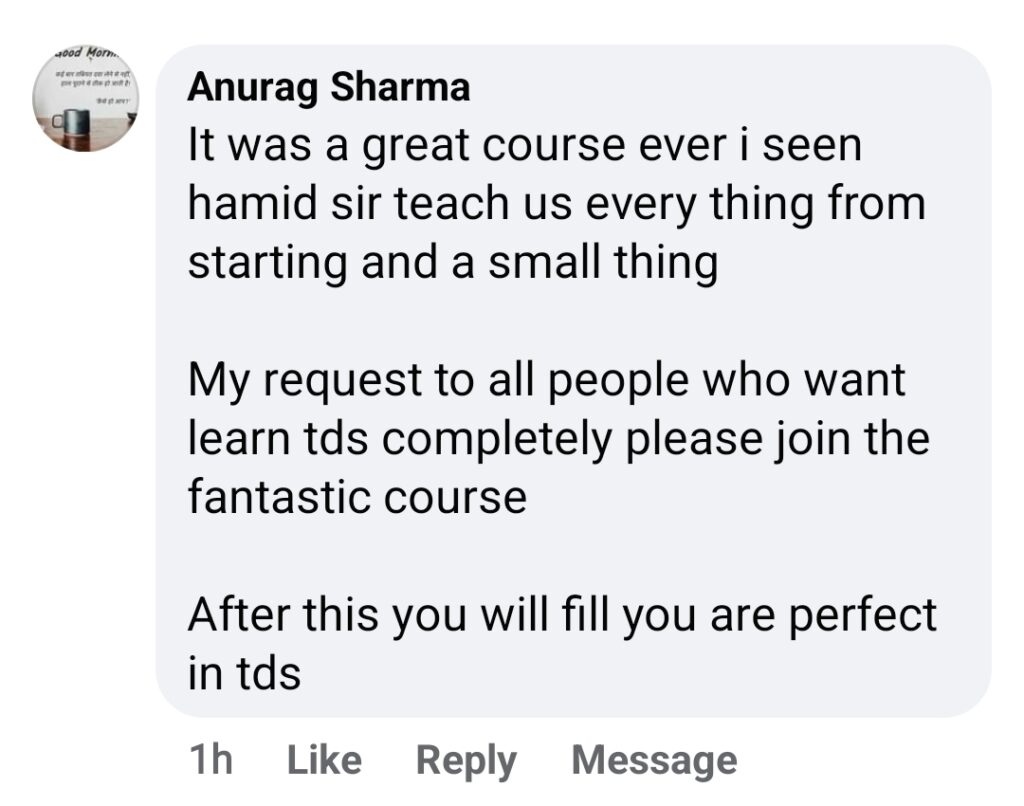

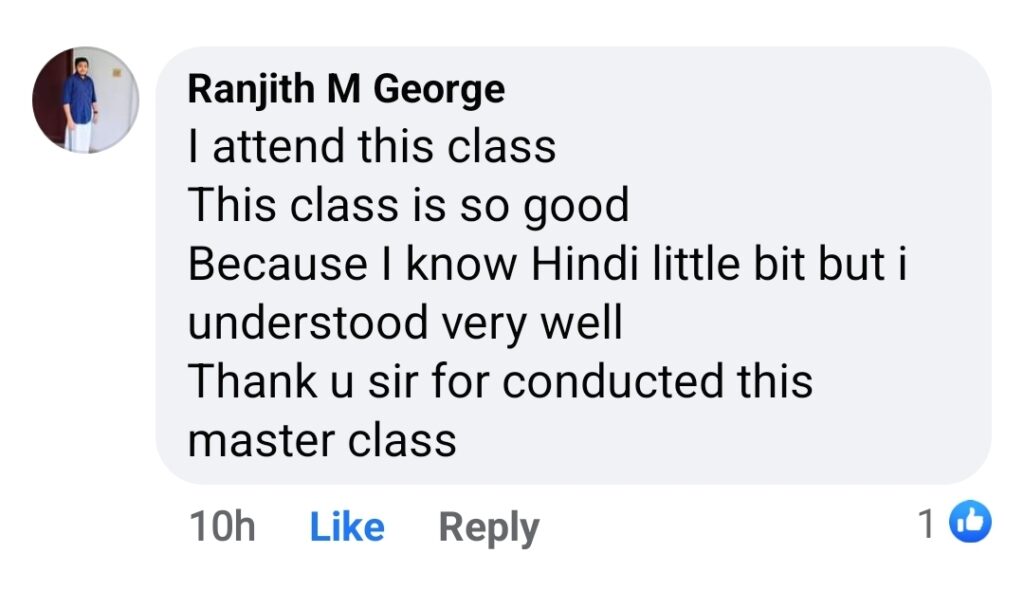

Master TDS in Just 4 Days — Practically, Powerfully & with AI

Tired of TDS confusion, portal errors & last-minute stress?….It’s time to learn TDS the smart way!

Join the 4-Day TDS LIVE Master Class

Duration: 4 Days (LIVE + Recordings) | Time: 9:00 PM – 10:30 PM | Certificate Included | Limited-Time Offer – Enroll Now!

Stop struggling….Start mastering

Join our Tax Audit Live Master Class and learn:

Clause-wise reporting in Form 3CA, 3CB & 3CD | Latest updates for AY 2025-26 | Practical filing for Individuals, Firms, LLPs & Companies

Designed by Hosting Cultures

WhatsApp us