In today’s fast-paced financial world, Accounts and Taxation professionals have become the backbone of every industry. From growing startups to large-scale corporations, every business needs skilled individuals who understand how money moves — how to manage it, report it, and keep it compliant with the law.

India, being one of the largest and fastest-growing economies, has a dynamic financial landscape. With tax reforms like GST and constant updates in income tax rules, the demand for trained accountants and tax professionals is rising sharply. If you’re someone who enjoys working with numbers, solving financial puzzles, and wants a stable, well-paying career — then this field is a goldmine of opportunities.

So let’s explore the Top 5 Career Opportunities you can step into after completing a course in Accounts & Taxation. We’ll also look at salary expectations, skills you need, and how you can get started.

Why a Career in Accounts & Taxation is a Great Choice in India

Before we dive into job roles, here’s why this field is considered one of the most rewarding in India:

Consistent Demand Across Industries

Every business needs accounting and taxation services — whether it’s a Kirana store, a D2C startup, or a multinational company.

High Job Security

With constant updates in tax laws, GST regulations, and audits, there is always a need for professionals to interpret and implement these changes correctly. This makes it a recession-proof career.

Lucrative Salary Potential

Accountants, tax consultants, and finance officers earn competitive salaries. Freelancers or self-employed consultants can scale their income significantly with more clients.

Flexible Work Options

You can work full-time in a company, partner with a CA firm, offer part-time freelance services, or even start your own consultancy.

Continuous Growth

With new rules (like e-invoicing, digital tax filing), and tech tools like Tally, Zoho, QuickBooks, the learning never stops — and neither does your growth.

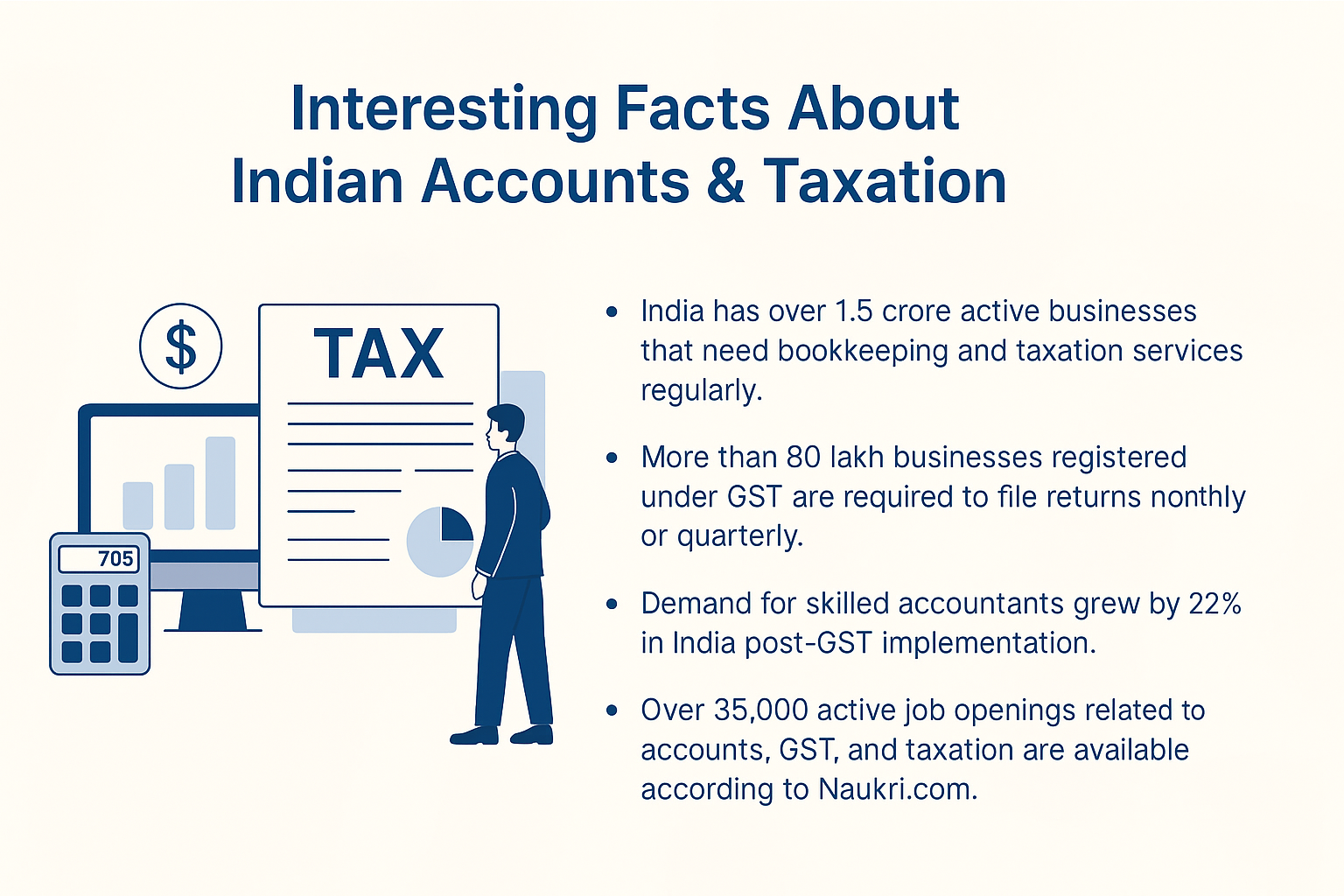

Some Interesting Facts about Indian Accounts & Taxation

- India has over 1.5 crore active businesses, all of which need bookkeeping and taxation services regularly.

- More than 80 lakh businesses are registered under GST, and they are required to file returns monthly or quarterly.

- The demand for skilled accountants grew by 22% in India post-GST implementation.

- According to Naukri.comhttps://www.naukri.com, over 35,000 active job openings are currently available for roles related to accounts, GST, and taxation.

- Freelancers handling GST filing charge between ₹500 to ₹1,500 per client per month — and with just 30-50 clients, they can build a sustainable income of ₹40K to ₹70K/month.

Top 5 Career Options After an Accounts & Taxation Course

- Tax Consultant / Tax Practitioner

What You’ll Do:

As a Tax Consultant, you’ll help individuals and businesses reduce their tax liabilities, file returns correctly, claim eligible deductions, and ensure they are fully compliant with tax laws. You’ll also handle things like TDS, GST filings, and responding to tax notices.

Skills Required:

- Strong knowledge of the Income Tax Act, TDS, GST

- Hands-on experience with ITR filing, GST returns

- Ability to interpret latest amendments and apply them

Where You Can Work:

- CA Firms

- Corporate Tax Departments

- Freelancing or own consultancy

- Online tax portals (like ClearTax, TaxBuddy)

Average Salary:

₹5 – ₹12 LPA

Freelancers can earn ₹50K–₹1L+ per month based on client volume.

Accounts Executive / Accountant

What You’ll Do:

As an Accounts Executive, you’ll manage daily financial transactions, ledgers, reconciliations, and help prepare balance sheets and financial reports. You’ll also support audits, compliance, and budgeting activities.

Skills Required:

- Knowledge of Tally, Zoho Books, or QuickBooks

- Journal entries, ledgers, P&L, and GST billing

- Accuracy and data integrity

Where You Can Work:

- Private Companies

- Schools & Colleges

- Retail & E-commerce businesses

- NGOs and Government-funded projects

Average Salary:

₹3 – ₹7.5 LPA

Higher in metro cities and for experienced candidates.

GST Practitioner / GST Return Filing Expert

What You’ll Do:

In this role, you’ll help businesses with GST registration, monthly/quarterly return filing (GSTR-1, 3B, 9), e-invoicing, reconciliation, and avoiding penalties. You ensure businesses stay GST compliant while claiming maximum benefits.

Skills Required:

- Expertise in GSTN portal operations

- GST law interpretation and filing protocols

- Knowledge of e-invoicing and amendments

Where You Can Work:

- Tax Consultancies

- E-commerce and Manufacturing companies

- Freelance or Start your own service

Average Salary:

₹5 – ₹8 LPA

Freelancers can earn ₹30K–₹80K/month depending on clients.

Payroll Executive / HR Accounts Coordinator

What You’ll Do:

You’ll be responsible for handling employee salaries, processing PF/ESI deductions, TDS, professional tax, and managing payroll software. You’ll act as a bridge between the accounts and HR departments.

Skills Required:

- Knowledge of statutory deductions: PF, ESI, TDS, Gratuity

- Familiarity with payroll software (Excel, Zoho, SAP)

- Attention to labor law compliance

Where You Can Work:

- IT companies

- Manufacturing units

- HR and Payroll outsourcing firms

Average Salary:

₹4 – ₹6.5 LPA

In larger companies, senior payroll executives earn up to ₹9 LPA.

Accounts & Taxation Trainer / Educator

What You’ll Do:

If you enjoy teaching, you can become a trainer who teaches accounts, GST, Tally, and tax return filing. This can be through live sessions, online platforms, or your own YouTube channel or institute.

Skills Required:

- Strong command over subject

- Teaching skills and ability to simplify topics

- Ability to create course modules, presentations, and videos

Where You Can Work:

- Online platforms (Udemy, Hamid’s Smart Learning Hub)

- Your own coaching business

- Offline training institutes

Average Salary:

₹5 – ₹10 LPA

Top educators can earn ₹1L+ monthly with a strong student base.

Bonus Career Path: Start Your Own Accounting & Tax Practice

Once you’ve built 2–3 years of experience and confidence, consider launching your own consultancy. You can start by offering services like:

- GST and ITR filing

- Bookkeeping and compliance

- Business registration (LLP, Pvt Ltd)

- ROC filings and MCA compliance

- Financial forecasting

- Loan or subsidy documentation support

With just 10–20 regular clients, you can build a monthly income of ₹50,000+ — and grow it further with reputation, word-of-mouth, and digital presence.

Additional Tools & Certifications That Give You an Edge

Tools You Must Learn:

- TallyPrime

- Excel

- GSTN Portal & ITR Portal

Recommended Certifications:

- Tally Certified Professional

- GST Practitioner Certification

- Advanced Excel for Finance

- Certification in Payroll Management

If you’ve completed your course from Hamid’s Smart Learning Hub, chances are you’ve already worked on these tools practically — a big plus when applying for jobs.

Real Success Starts With Practical Skills

It’s no longer enough to just have a degree or certificate — employers want real, job-ready skills.

At Hamid’s Smart Learning Hub, students don’t just “learn” — they apply what they learn using real-time case studies, simulated filing exercises, and hands-on accounting tasks. That’s why 15,000+ learners across India trust us to kickstart their finance careers.

What Makes Us Different?

- 100% Practical Training

- Job-Oriented Curriculum

- Lifetime Course Access

- Mentorship & Interview Support

Ready to Start Your Career?

👉 Join Hamid’s Accounts & Taxation Course Today and become a finance pro that companies trust.

📍 Visit: https://hamidssmartlearninghub.com

Final Words

A course in Accounts & Taxation isn’t just a qualification — it’s a powerful career launchpad. Whether you want a stable job, a side hustle, or to build your own practice, the opportunities are endless.

So, if you’re ready to take the next big step in your professional life, this is your moment.

📢 Join Hamid’s Smart Learning Hub today — and shape your future, one balance sheet at a time.